2021 Report: Thriving despite a tough year

Jan 02, 2022

The beginning of a new year is often a good time to reflect on the year that has passed, as well as map out our aspirations for the months ahead.

These past 2 years have been especially tough.

So this is a good time to take a look back at what the ChooseFI International Foundation was able to accomplish despite the pandemic.

2021 Overview

Before we get into reviewing 2021, allow me to apologize for missing this report for 2020.

2020 was a challenging year for many people, and that had an impact on donations to the Foundation.

We had to pivot and make drastic cuts to ensure the Foundation’s survival.

The steps taken throughout 2020 allowed us to enter 2021 on a solid financial footing and to reach out to more people.

With that caveat out of the way, let’s take a look at how we did financially in 2021.

As a 501 c 3 non-profit organization associated with the ChooseFI podcast, we have been laser-focused on doing more with less.

In 2021, we received $20,671.51 in donations, including a large amount by a few members of the Foundation’s Board members.

Our annual expense was $15,628.71, or just $1,300 a month.

We were able to get by with so little because most of the course creation had been done in 2020. This let us make deep cuts in our operational expenses by retaining just one team member to continue engagement on social media.

Another way we significantly slashed our operating expenses was by consolidating our website, learning management system, and email communication into a single technology platform.

Our Impact

In 2021, we helped almost 10,000 people improve their financial lives. We broke down the results based on our 2 main programs, FI 101, and the PreK-12 Curriculum.

Financial Independence 101

In 2021, about 5,500 people signed up for FI 101. This number is rounded down from the 5,584 captured in the image below to exclude some people who signed up at the tailend of 2020.

In total, the FI 101 course has helped more than 16,580 people improve their financial well-being since we first launched it in 2020 on Teachable, the former platform before we consolidated our tech stack to save money.

Here is some of the feedback from a few of the people whom we have helped (you can see these in the comments section of the FI 101 course:

"Thank you for all the teachings and resources. I can't wait to step up my game with investments." - Gabriela Diaz

"It's always useful to review the fundamentals and see where I could improve. I hadn't calculated my expenses or savings rate in a few years, didn't appreciate the tax savings from pre-tax accounts now that I'm making more, and hadn't applied for life insurance yet. I'm going into 2022 with a stronger financial plan, so thanks!" - Rob Flannigan

"Thanks so much for your very valuable training and education. I really enjoyed it, and appreciated that you made it fun, interesting with audio and visual. I feel much better prepared to deal with different money matters. Thank you for your wisdom, experience and personable presentation." - Tony Valdez

PreK-12 Financial Literacy Curriculum

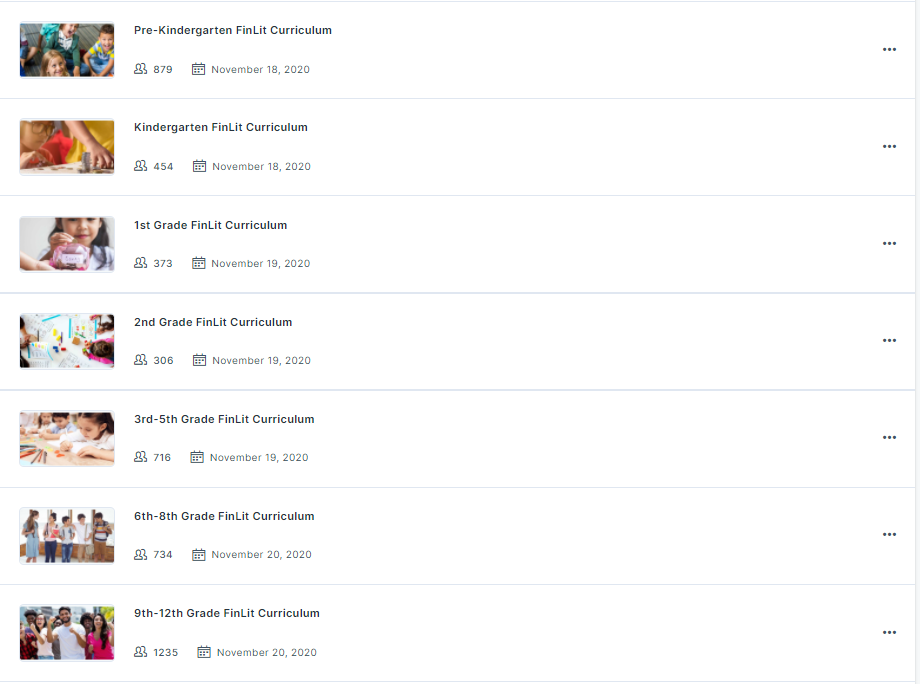

2021 saw about 4,400 educators (and parents) accessing the Foundation's financial literacy curriculum for students ranging from Pre-Kindergarten through 12th grade.

These educators are incredible force multipliers in bringing financial literacy to future generations, and are excited about how many more lives will be changed for the better.

As with FI101, the numbers for PreK-12 are rounded down):

$1.58 to help a person discover financial literacy

Taken together, that makes a total of 9,900 people, of which around 4,400 were teachers using it in their own classes.

Despite a difficult 2 years, I’m proud of what our team has been able to accomplished on such a tight budget.

Looking at the math, it cost us $1.58 to help one person improve their financial literacy. That metric was derived by taking our 2021 expenses of $15,628.71 and dividing that by 9,900.

A blunt estimate for sure, but a helpful one nonetheless.

Essentially, in 2021, a $5 donation paid for 3 people to discover financial literacy. Since many donations to the Foundation were between $5-$10, it’s gratifying for us to know that every little bit made a tangible impact.

Focus for 2022

This year, our goal is to DOUBLE the number of people using our resources to improve their financial life.

That means double the number of educators (8,800) accessing our PreK-12 Curriculum, and double the number of people signing up for FI 101 (11,000).

We feel this is attainable since most of the growth we saw in 2021 were organic.

To do that, we will continue to engage organically on Facebook and Instagram, but also, begin to invest in targeted ads on these two platforms.

Will You Help Us?

We need your help to bring financial literacy to more people in underserved communities. Could you please do the following 3 things?

- Share with someone you know the PreK-12 FinLit Curriculum (if they are an educator) or the FI 101 course. Both are absolutely and forever free!

- Share this post on your personal Facebook or Instagram account.

- Help 3 others discover financial literacy with a small, one-time $5 donation.

Wrapping Up

Before I wrap up this update, it would be remiss of me not to recognize the following people on the team:

Lindsay N. Giroux (Pre-K FinLit), Dani Mendonsa (Elementary FinLit), Mandy Bert (Middle School FinLit) and Robert Phelan (High School FinLit) for the Herculean task of completing the PreK-12 Curriculum in 2019.

Likewise, thanks to Stephen Heptig and Melissa Lagerquist for completing FI 101 in the same timeframe.

Special thanks to Valerie Clark, who volunteered to help us with our newsletter updates to our supporters and community.

And finally, a shoutout to my fellow board members Paula Pant, Shawn Jenkins, Jonathan Mendonsa, and Brad Barrett for helping us keep going when the going got tough.